Currency

Exchanging Money in Europe

Exchanging money in Europe doesn’t have to be a hassle if you know the smartest ways to handle your finances abroad. From navigating ATM fees to knowing when (and where) to avoid currency exchange offices, a little planning can go a long way in saving you time and money. Whether you’re hopping across iconic cities or exploring hidden gems, using the right credit card and understanding how to access euros on the go will keep you prepared—and help you get the best value for every euro.

Why we prefer ATM’s

We prefer not to carry around large amounts of US dollars or Euros so we use ATMs more frequently. While most ATMs in Europe charge a fee for withdrawing the local currency (usually $3-$5), we both have banks (Charles Schwab and USAA) that refund our ATM fees and do not charge us even when we are overseas. These are not the only debit cards that provide this service, but these are the two that we can personally vouch for. We also prefer to use ATM’s because usually, the US banks will give you a better exchange rate than you will get at the money exchange offices.

For some countries, such as Germany, cash is king and is normally the only option when paying for smaller purchases. You can usually pay with credit cards at all supermarkets and restaurants. In general, it is always good to have a little bit of cash on hand in Europe. See the list of countries that use the Euro as a currency.

Decline the ATM Conversion

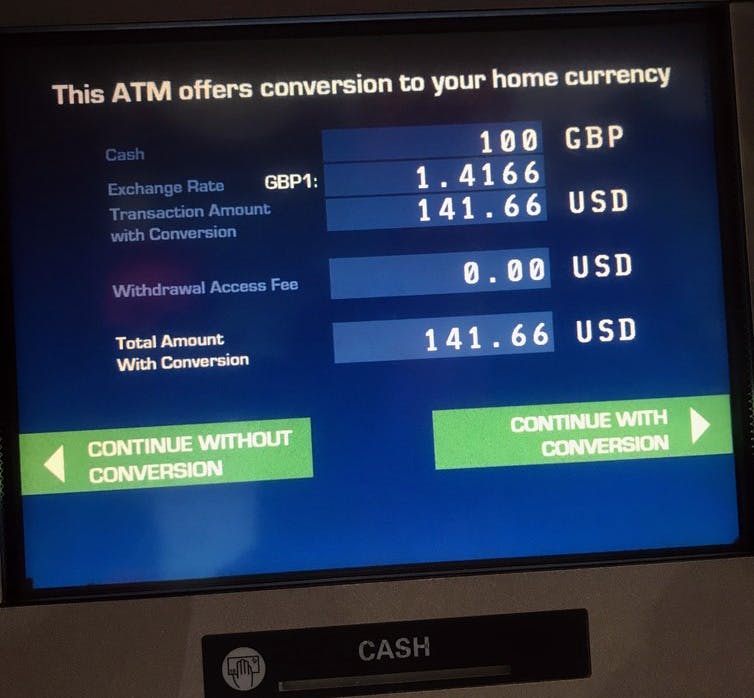

One final recommendation about ATMs is that you should always decline any conversion that is offered by the ATM. The conversion is not always offered, however, when offered it is always an unfavorable exchange rate. Make sure you pay attention to this because often they put the conversion offer before you would normally select confirm (to receive money) so that you will mistakenly confirm the conversion without noticing.

The wording on the conversion offer implies that they are helping you by locking in this conversion rate now, but we can assure you that they are not helping you. The ATMs can charge you up to an extra 25% compared to the conversion rate that you would receive from your bank.

Money Exchange Offices

If you prefer to exchange your money into the local currency the rates at the airports are typically worse than the rates in the city centers in Europe. So we would recommend using your credit card at the airport. If this is not possible then we recommend exchanging only enough money to get you to the city center (enough to pay for a public transportation ticket or taxi) and then exchanging the rest of your money in the city center.

We will explain how to get from the airport to the city center in detail on your customized itinerary. Our explanation will include whether you can use a credit card or if you will need to change some money or withdraw some money at the airport. Once in the city center, you can use one of the reputable money exchange offices that we will suggest to you to exchange your money.

Credit Cards

Why we prefer to use our credit cards overseas

When we are outside of the US we use our credit cards as much as possible. There are several reasons for this. First, both of our travel credit cards give us miles in exchange for our travel spending so we earn free flights by using our credit cards to buy things we would have purchased anyway.

Second, our Chase credit cards (like many others) have no foreign transaction fees and give us a favorable exchange rate on transactions. Finally, by using our credit cards we do not have to carry around a lot of cash, which we feel is better. We have used both the “United Mileage Plus” card and the “Chase Sapphire” card.

Always Pay in the Local Currency

When paying with credit cards always pay in the local currency of the country that you are in (instead of USD) because your bank gives you a better exchange rate than the third party vendor. When you pay with your credit or debit card at a vendor, you will be given two options before your payment is finalized.

If you make the mistake once or twice do not worry. It is not a huge difference, but over the length of your trip it will definitely add up. Most places in Europe accept credit cards, but some places are less credit card friendly.